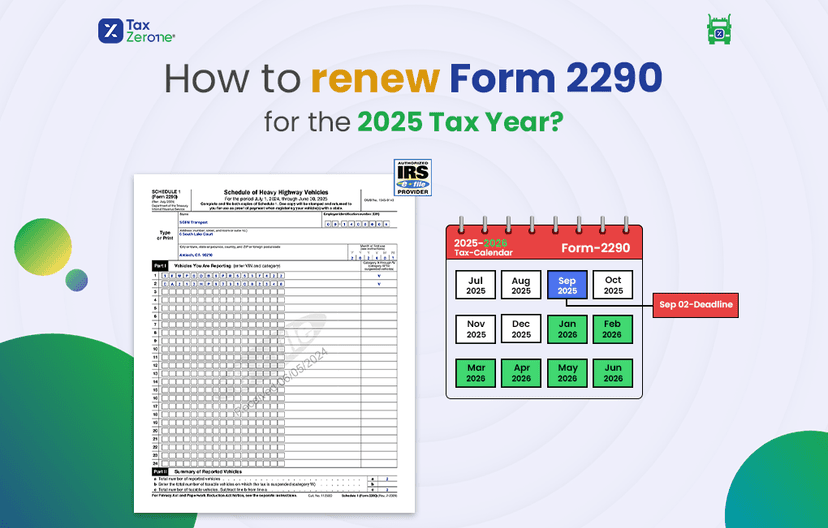

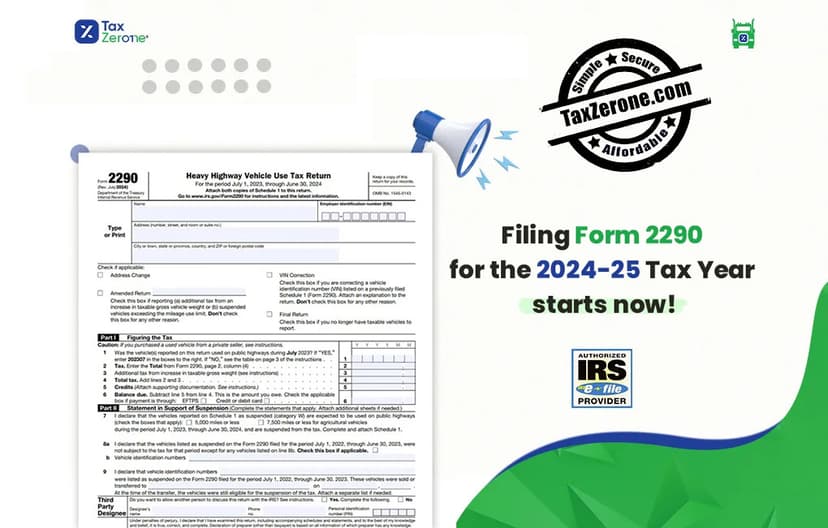

Missed the deadline? E-File Form 2290 now and get your stamped Schedule 1 to reduce IRS penalties.

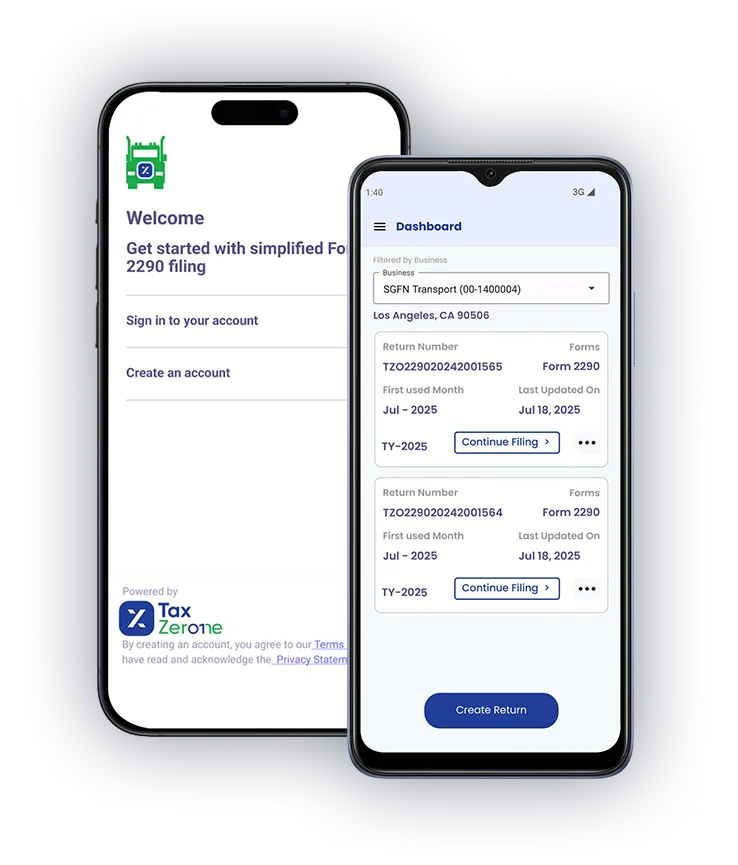

E-File IRS Form 2290 Online with TaxZerone

File your Heavy Vehicle Use Tax and receive IRS-stamped schedule 1 in minute.

Starts at just $19.99 per return